How-To Guides

Say Goodbye to Spotify Premium without Hassle

Imagine this scenario. You’ve been enjoying Spotify Premium for months, but now you want to save a few bucks or try another music streaming service. Whatever the reason, canceling your Spotify Premium subscription should be a straightforward process. Don’t worry; we’ve got you covered with this comprehensive guide.

How To Cancel Spotify Premium

This post will walk you through the steps you need to take to cancel your Spotify Premium subscription. We’ll also discuss what happens when you switch back to the free plan and address some common questions. By the end of this guide, you’ll feel confident managing your Spotify account like a pro.

Why You Might Want to Cancel Spotify Premium

Before jumping into the how-to, let’s explore some reasons why you might want to cancel your Spotify Premium subscription.

Budget Concerns

Monthly subscriptions can add up quickly. If you’re looking to tighten your budget, canceling Spotify Premium can save you around $10 a month.

Using Alternative Services

Maybe you’ve found another music streaming service that better suits your needs. Whether it’s Apple Music, Tidal, or Amazon Music, many options offer different features that might appeal to you more.

Limited Usage

If you find yourself not using Spotify as much as you thought, it might make sense to switch back to the free version. This way, you can still enjoy music without the extra cost.

What Happens When You Cancel Spotify Premium

Understanding what happens when you cancel can help you decide whether it’s the right choice for you.

Reverting to Free Version

When you cancel, your account reverts to the free Spotify plan. This means you will still have access to your playlists and saved music, but with some limitations like ads and restricted song selection.

Loss of Offline Listening

One of the main perks of Spotify Premium is offline listening. When you cancel, you’ll lose access to downloaded songs. They’ll be removed from your devices once your current billing cycle ends.

Retaining Playlists and Followed Artists

Good news! Your playlists and followed artists remain intact. You can still stream your favorite tracks and discover new music, but be prepared to hear some ads.

Step-by-Step Guide to Cancel Spotify Premium

Ready to cancel? Follow these steps to get it done easily.

Step 1: Log in to Your Spotify Account

The first step is to log into your Spotify account. Head over to Spotify Account and sign in using your Spotify credentials.

Step 2: Access Your Account Settings

Once logged in, go to your account settings. Look for options related to your subscription under “Your plan” or “Manage your plan.”

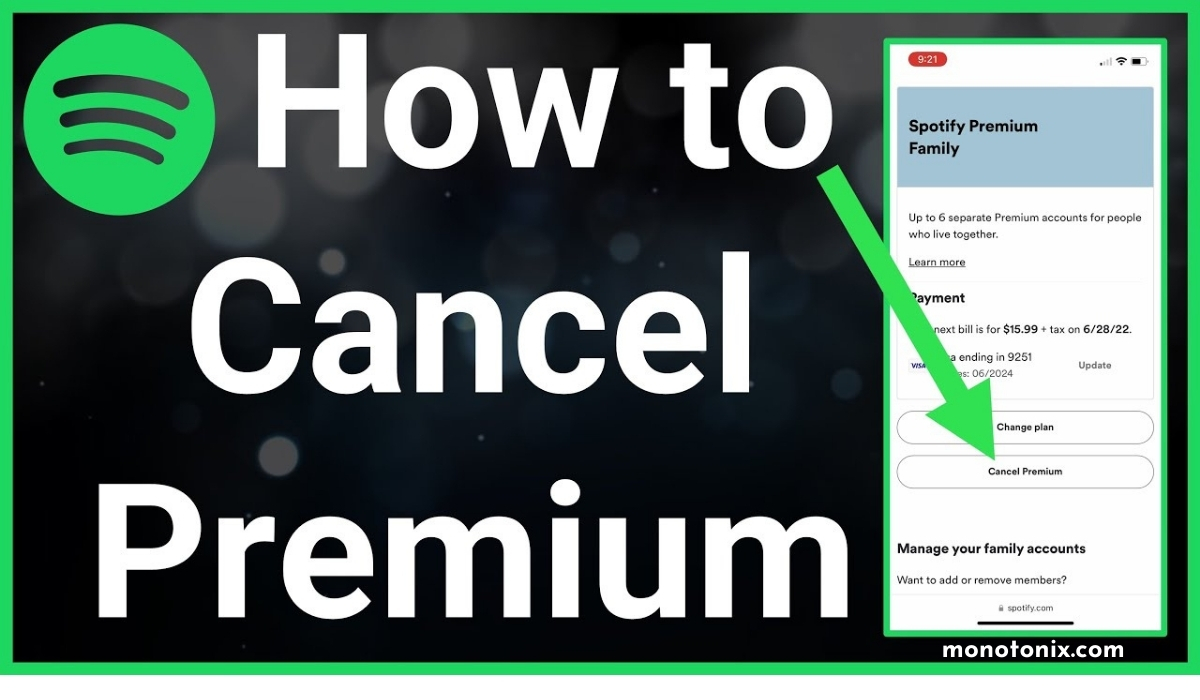

Step 3: Cancel Premium

Look for the option to cancel or downgrade your plan. It might be labeled “Cancel Premium” or “Change to Free.” Click on this option to proceed.

Step 4: Confirm Cancellation

Spotify might ask you to confirm your decision. Click “Yes, Cancel” or a similar option to finalize the cancellation.

Troubleshooting Common Issues

Sometimes, things don’t go as planned. Here are some common issues you might encounter and how to resolve them.

Missing Change Plan Option

If you don’t see a “Change plan” option, your subscription might be managed by a partner company, such as your phone carrier. In this case, the instructions for cancellation will be displayed on your account page under the “Payment” section. You’ll need to contact that partner company directly to cancel.

Premium Access Until Billing Cycle Ends

Even after canceling, you will still have access to Spotify Premium features until the end of your current billing period. This gives you some extra time to enjoy your benefits before switching to the free plan.

Confirmation Email

After successfully canceling, you should receive a confirmation email from Spotify. Keep this email for your records, just in case there are any issues later.

The Impact of Canceling on Family and Student Plans

If you’re part of a family or student plan, canceling your subscription might affect others.

Family Plans

When the main account holder cancels a family plan, all members will revert to the free plan. Make sure to inform everyone in advance.

Student Plans

Canceling a student plan will revert your account to the free version. If you’re still eligible, you can reapply for the student discount later.

Exploring Alternatives to Spotify Premium

Canceling Spotify Premium doesn’t mean you have to live without music. Here are some alternatives.

Free Version of Spotify

The free version of Spotify still offers a vast library of music and podcasts. While you’ll encounter ads and have limited skipping capabilities, it’s a great way to enjoy music without paying.

Apple Music

Apple Music offers a vast library and integrates well with other Apple devices. They also provide a three-month free trial for new users.

Tidal

Known for its high-fidelity sound quality, Tidal is a great option for audiophiles. They also offer exclusive content and early access to music releases.

Amazon Music

If you’re an Amazon Prime member, you already have access to Amazon Music’s basic tier. Amazon Music Unlimited offers a broader selection for a monthly fee.

How to Make the Most of the Free Spotify Plan

Switching to the free plan? Here are some tips to get the most out of it.

Creating Playlists

Create playlists for different moods and activities. This way, you can easily find the perfect playlist without searching every time.

Discover Weekly and Daily Mixes

Spotify’s algorithm creates custom playlists like Discover Weekly and Daily Mixes based on your listening habits. These are great for discovering new music.

Following Artists and Podcasts

Follow your favorite artists and podcasts to get updates on new releases and episodes. You’ll never miss out on fresh content.

Tips for Managing Your Subscriptions

Managing subscriptions can be tricky. Here are some tips to help you stay on top of things.

Regularly Reviewing Subscriptions

Take time each month to review your subscriptions. Cancel those you don’t use often to save money.

Using Subscription Management Apps

Apps like Truebill and Mint can help you track and manage your subscriptions, making it easier to stay organized.

Setting Reminders for Billing Cycles

Set reminders for billing cycles to avoid unexpected charges. This helps you cancel in time if you decide not to continue a subscription.

YOU MAY ALSO LIKE

Soaper TV: Elevate Your Streaming Experience to New Heights

Frequently Asked Questions About Canceling Spotify Premium

Here are some common questions and answers about canceling Spotify Premium.

Can I Cancel Anytime?

Yes, you can cancel your Spotify Premium subscription at any time. You’ll still have access to Premium features until the end of your billing cycle.

Will I Lose My Playlists?

No, you won’t lose your playlists. They will still be available when you switch to the free plan.

How Do I Cancel if My Subscription is Through a Partner?

If your subscription is managed by a partner, such as your phone carrier, follow the instructions on your Spotify account page under the “Payment” section. Contact the partner directly to cancel.

What Happens to My Downloaded Songs?

Downloaded songs will be removed from your devices once your current billing period ends. You’ll still have access to your playlists but will need an internet connection to listen.

Final Thoughts

Canceling Spotify Premium is a straightforward process, but it’s important to understand the implications. By following the steps outlined in this guide, you can easily manage your subscription and make informed decisions about your music streaming needs.

Take Action Today

If you’re ready to cancel your Spotify Premium subscription, log into your account and follow the steps above. Remember, you can always switch back to Premium if you change your mind. Happy listening!

How-To Guides

Understanding Your Human Design Chart: A Beginner’s Guide

Welcome to the fascinating world of human design, a system that combines principles from astrology, the I Ching, Kabbalah, and the chakra system to create a unique genetic map of an individual’s personality. Understanding your human design chart can lead to greater self-awareness, improved relationships, and the ability to make choices that align with your true nature. Embarking on this journey requires an openness to explore the intricate aspects of one’s personal makeup and the cosmic influences at the time of their birth. In this article, we’ll delve into the foundational elements of human design and provide you with the key insights to begin interpreting your chart.

Exploring the Basics of Your Human Design Chart

The human design chart, also known as a bodygraph, is a visual representation of the energetic makeup of an individual. It outlines various components that influence your character and experiences. The chart is generated based on your birth data, similar to an astrological birth chart, and presents a complex system of shapes, lines, and numbers. To start, one needs to know their exact birth time, date, and place, as these factors are critical in chart calculation.

Once the chart is generated, you’ll notice it is composed of nine geometric shapes, known as centers, which are connected by lines called channels. Each center corresponds to a specific aspect of your being, such as your mind, emotions, or willpower. These centers can be either defined (colored) or undefined (white), indicating consistent themes in your life or areas where you are susceptible to external influences.

A crucial part of understanding your human design chart is the Human design chart itself. An authentic human design chart offers deep insights into who you are at the core. To thoroughly understand your chart, it’s often beneficial to consult with an experienced human design analyst who can guide you through the complexities of the system.

Interpreting the numerous elements of your human design requires patience and study. This visual tool encapsulates not only the mechanics of your personality but also provides a blueprint for living in a way that honors your individuality. As you become more familiar with the symbols and their meanings, you’ll gain a clearer perspective on your internal mechanics.

Deciphering the Five Types in Human Design

The human design system categorizes individuals into five distinct types: Manifestors, Generators, Projectors, Reflectors, and Manifesting Generators. Each type has a unique way of interacting with the world and fulfilling their purpose. For instance, Manifestors are the initiators, empowered to manifest change and impact their environments directly without waiting for external cues.

Generators, the most populous type, have a seemingly inexhaustible energy reservoir for work they love, and they wait to respond to the world around them to unlock this energy. Projectors, on the other hand, possess a natural insight into systems and people, but they thrive when recognized and invited to share their wisdom. Reflectors are rare, mirroring the health of their environments, and they need a full lunar cycle to make decisions that align with their identity.

Manifesting Generators are a hybrid of Manifestors and Generators, capable of rapid action like Manifestors while also waiting to respond before leaping into action like Generators. Each type operates optimally when following their strategy, which is a guideline for making decisions and interacting with the world in a way that aligns with their design.

Understanding these types and strategies is pivotal for self-awareness. It allows individuals to tune into their innate tendencies and learn to navigate life with less resistance. By knowing your type, you can start to experiment with your strategy and witness the transformative impact of aligning with your human design.

Understanding Centers, Channels, and Gates

At the core of your human design chart are the centers, channels, and gates. The nine centers are akin to chakras and represent different attributes of your being, such as communication, love, and logic. Defined centers (colored in) represent attributes that are consistent within you, while undefined centers (white) are areas where you may be influenced by others or the environment.

Channels are the pathways that connect two centers, and their status – defined or undefined – influences how energy flows through your chart. A defined channel indicates a fixed way energy moves between centers, forming a consistent part of your personality. Undefined channels suggest potential or variability in how these energies can manifest, often influenced by timing or other people.

Gates are specific energies located within the centers and are activated by planetary positions at your birth. Each gate carries a particular theme or lesson that is relevant to your life experience. When a gate is activated, it contributes to your unique way of being in the world, affecting your strengths, challenges, and potential for growth.

Understanding the interaction of centers, channels, and gates provides a deeper comprehension of the mechanics of your human design. Recognizing where you have consistency and where you are open to the world allows for a greater sense of peace and self-acceptance. It is through these intricate details that your uniqueness is expressed, giving you insights into your innate gifts and the areas where you have the potential to develop and evolve.

The Role of Authorities in Decision Making

In human design, authorities represent your inner compass for making correct decisions. It differs from the concept of authority in everyday parlance, referring instead to the specific center in your bodygraph that holds the key to decision-making. Following your authority helps you make choices that truly align with who you are.

There are seven authorities in human design, with the Solar Plexus (Emotional) authority being the most common. Depending on your type and chart configuration, you may be led by a different authority such as Splenic, Sacral, or even the rare Self-Projected authority. These authorities can be thought of as the decision-making mechanisms within you, each with its own way of guiding you to clarity and purpose.

For example, those with a Sacral authority are advised to listen to their gut responses to find truth, while those with a Splenic authority benefit from paying attention to their intuitive hits. Projectors with Self-Projected authority need to talk things out to hear their truth, and Reflectors are advised to wait a full lunar cycle to allow all perspectives to be considered before deciding.

Understanding and trusting your authority is transformative, as it can alter the way you approach decisions, large and small. By recognizing and honing in on your innate decision-making process, you encourage a life that is more in tune with your true self, paving the way for greater authenticity and satisfaction.

Unpacking Your Profile and How It Influences Your Life Path

The profile in your human design chart is another vital component of understanding your personal mechanics. It consists of two numbers, derived from the I Ching, which together reveal the archetype that shapes the way you interact with the world and fulfill your life purpose. The twelve profiles, combinations of the lines one through six, each describe unique characteristics and themes that influence your life journey.

Each line within the profile has a distinct significance – the first line represents your internal process, while the second line points to your natural talents. As the lines progress, they move from introspective to extroverted nature, with the sixth line representing the role model. Your profile provides insight into your personality traits, the roles you are meant to play, and the best ways for you to engage with others.

Understanding your profile can be a revelatory experience that shines a light on the patterns in your relationships, career, and overall life trajectory. It assists in gauging how you project yourself into the world and how others perceive you. As you become acquainted with the energies of your profile, you can lean into your strengths and navigate life with more ease and confidence.

Profiles are not static labels but dynamic aspects of your design that unfold over time. They offer a framework for personal development, showing the path for growth and the environment in which you are likely to thrive. Embracing your profile can lead to a profound acceptance of your nature and empower you to take steps aligned with your true calling.

Overall, human design offers a rich and complex system for understanding yourself and how you are meant to interact with the world. By exploring the intricacies of your human design chart, you can begin a journey toward living a life that celebrates your uniqueness and harnesses your inherent strengths. As you continue to study and apply the principles of human design, you’ll uncover the wisdom of aligning with your true nature, leading to a more authentic and fulfilling existence.

How-To Guides

From Hoarding to Harmony: Professional Junk Removal for Mental Clarity

The spaces we inhabit have a profound effect on our mental health and overall well-being. Excessive clutter is not just an aesthetic issue; it can lead to stress, anxiety, and can even contribute to the feeling of being overwhelmed in one’s own home. As society becomes more aware of the psychological repercussions of hoarding, more people are seeking strategies to declutter their lives. Professional junk removal services emerge as an effective solution to this problem, offering not just physical relief but mental clarity as well. Below, we will delve into how decluttering can improve mental health and the role professional junk removal services play in this process.

How Professional Junk Removal Services Can Facilitate Positive Change

Confronting a cluttered space can be daunting, and the task of decluttering can be overwhelming. This is where professional junk removal services come into play. These services provide an efficient way to dispose of unwanted items without adding stress to the individual. By handling the physical labor, they allow clients to focus on the emotional aspects of decluttering.

Professional junk removal services can also offer an objective perspective. As experts, they provide guidance on what items can be recycled, donated, or discarded, which can be particularly helpful for individuals who struggle with attachment to their belongings. This external input can accelerate the decluttering process and prevent second-guessing.

The convenience of using professional services cannot be overstated. Dealing with municipal disposal rules, sorting recyclables, and potentially hazardous materials can be complicated and time-consuming. When booking a service like the Oahu Dump Run, clients can trust that their junk will be disposed of responsibly while they reclaim their living space.

The Link Between Decluttering and Improved Mental Clarity

Decluttering is not just a physical action; it’s a cathartic process that can help clear the mind and ease mental burdens. As the physical space around an individual becomes more organized, the mind often follows. An orderly environment can foster a sense of control and accomplishment, which can be incredibly empowering, particularly for those feeling overwhelmed by their surroundings.

This process of decluttering can also promote decision-making skills and problem-solving abilities. Choosing what to keep and what to discard requires intentional thought, which can strengthen cognitive functions. The clarity gained through sorting and organizing can transcend into clearer thought processes and goal-setting, allowing individuals to focus on their aspirations.

Mental clarity is also closely related to better sleep patterns. A decluttered bedroom, for instance, can create a calming atmosphere conducive to rest and relaxation. Sleep is a critical factor in mental health, and improving sleep quality can have a significant positive effect on one’s mood and energy levels.

The Process of Professional Junk Removal: From Initial Assessment to Final Haul

The process of professional junk removal is designed to be as smooth and non-disruptive as possible. It typically begins with an initial assessment where the service provider evaluates the scope of the job. This is a crucial step in understanding the amount of work involved and in providing an accurate estimate to the client.

Next comes the sorting and categorization phase, where items are separated based on their destination—whether they will be donated, recycled, or taken to the landfill. This exercise in categorization is also beneficial for clients, as it brings awareness to the quantity and types of items that have accumulated over time.

Embracing a Minimalist Lifestyle for Lasting Mental Harmony and Clarity

Understanding the benefits of decluttering leads some individuals to adopt a minimalist lifestyle. Minimalism is more than a design aesthetic; it’s a philosophy centered around the idea that less is more. By owning fewer possessions, individuals can focus on what truly matters to them, reducing stress and fostering a greater sense of freedom.

Embracing minimalism often begins after experiencing the transformative effect of decluttering. As people feel the mental relief and increased clarity that comes from a tidy environment, they begin to apply the principles of minimalism in other areas of their lives. This may include simplifying schedules, committing to fewer but more meaningful possessions, and cultivating relationships and experiences over material goods.

Altogether, the journey from a cluttered home to one of tranquility is not merely about discarding belongings. It is a transformation that can liberate the mind and invite mental clarity. By leveraging professional junk removal services and embracing a minimalist mindset, individuals can pave the way for improved mental well-being and a more harmonious lifestyle overall.

How-To Guides

Decluttering 101: The Benefits of Using a Junk Removal Service

In a world where consumerism often leads to an abundance of unwanted items, the need to declutter has become more apparent than ever. Many homeowners and businesses face the challenge of disposing of their excess belongings responsibly and efficiently. Junk removal services have emerged as a valuable solution to this growing problem, offering a convenient way to clear out unwanted items without adding to the already overflowing landfills. By eliminating the hassle associated with disposing of bulky waste, these services not only provide immediate relief but also support environmental sustainability. Below, we explore the numerous advantages of enlisting the help of professional junk removers.

Understanding the Rise of Junk Removal Services

With growing populations and limited space, the demand for junk removal services has surged. People now prefer the ease of hiring professionals to handle sorting and disposal, rather than dealing with the mess themselves. The shift toward eco-conscious living also plays a role, as more consumers seek services that recycle and dispose of waste responsibly.

Businesses, too, are turning to services like junk removal in Burlington to manage large volumes of waste while staying compliant with environmental standards. From home cleanouts to commercial projects, the industry’s flexible offerings continue to attract a wide range of customers.

The Environmental Impact of Proper Waste Disposal

Junk removal services are crucial in today’s eco-conscious society for ensuring the safe disposal of waste products. They sort, recycle, and dispose of waste in ways that minimize harm to the environment, reducing pollution and strain on natural resources. Junk removal services divert waste from landfills, preventing landfill overflow and soil contamination.

They also partner with recycling centers and donation facilities to save reusable items like metals, plastics, and textiles. This supports recycling industries and encourages the conservation of raw materials. Junk removal professionals are trained to handle hazardous materials like electronics and chemicals, ensuring their safe disposal to prevent environmental contamination and health risks. Junk removal services contribute to a healthier environment and sustainable living.

How Junk Removal Services Promote Mental Well-being

Junk removal services can alleviate the psychological effects of clutter, leading to increased stress levels. Clearing space and creating a more organized environment can be therapeutic, providing a sense of relief and accomplishment. A clutter-free space can improve focus and productivity, leading to improved mental clarity.

Living in a clutter-free space can enhance one’s quality of life, making them feel calmer and more in control. Junk removal services can also be beneficial for individuals struggling with hoarding or finding it difficult to let go of possessions. They provide an objective and compassionate approach to decluttering, making the process less daunting and more manageable.

Junk Removal Services vs. DIY: Efficiency and Safety Considerations

When choosing between junk removal services and a DIY approach, factors like time, effort, and safety must be considered. Professional junk removers offer efficiency and safety, completing jobs that may take days or weeks for individuals. They are trained to handle risks like injury or property damage, ensuring a smooth clean-up process.

DIY methods may seem cost-effective initially, but hidden costs like dump fees and equipment rentals can add up. Junk removal services offer straightforward pricing, including labor, transportation, and disposal fees, providing a transparent financial transaction. The legal aspect of waste disposal should not be overlooked, as improper disposal can lead to fines and environmental citations. Junk removal services are knowledgeable about local regulations, providing peace of mind and legal protection to clients.

Evaluating the Cost-Effectiveness of Professional Junk Hauling Services

Professional junk removal services offer both direct and indirect savings. They provide convenience and time savings, allowing individuals to focus on other activities or work. For businesses, outsourcing waste management allows them to focus on core activities, boost productivity, and maintain a clean workspace.

Professional junk removal can prevent long-term costs like pest control issues and property damage due to improper storage. The rising trend of repurposing and upcycling has allowed junk removal services to offer competitive rates, as they recover materials and goods for resale or recycling, reducing costs for clients.

Altogether, the advantages of using a junk removal service are clear, from environmental responsibility to mental well-being. When it comes to decluttering, the expertise, efficiency, and safety provided by professional junk haulers prove to be a sound investment for both individuals and businesses alike.

-

Education6 months ago

Education6 months agoMastering Excel: Your Comprehensive Guide To Spreadsheets And Data Analysis

-

Tech9 months ago

Tech9 months agoHow To Choose The Best Forex Trading Broker?

-

Business1 year ago

Business1 year agoExploring the Rental Market: Properties for Rent in Malta

-

Blog6 months ago

Blog6 months agoArab MMA Fighters Shine Bright: Meet the Champions of PFL MENA

-

Travel10 months ago

Travel10 months agoExperience the Best Desert Safari Dubai Offers!

-

How-To Guides1 year ago

How-To Guides1 year agoComprehensive Guide to Cockwarming: Enhancing Intimacy and Connection

-

Home Improvement1 year ago

Home Improvement1 year agoEco-Friendly Round Rug Options for Sustainable Living in NZ

-

Apps and Games1 year ago

Apps and Games1 year agoDiscover Tickzoo: The Ultimate Platform for Video Content Lovers and Creators